All Categories

Featured

Table of Contents

It likewise allows a financier to participate without being counted towards the optimum number of financiers that are otherwise permitted in an offering exempt under Law D. In July 2010, President Obama signed the, which made a vital amendment to the definition, because the worth of a main residence might no longer be included in a person's total assets.

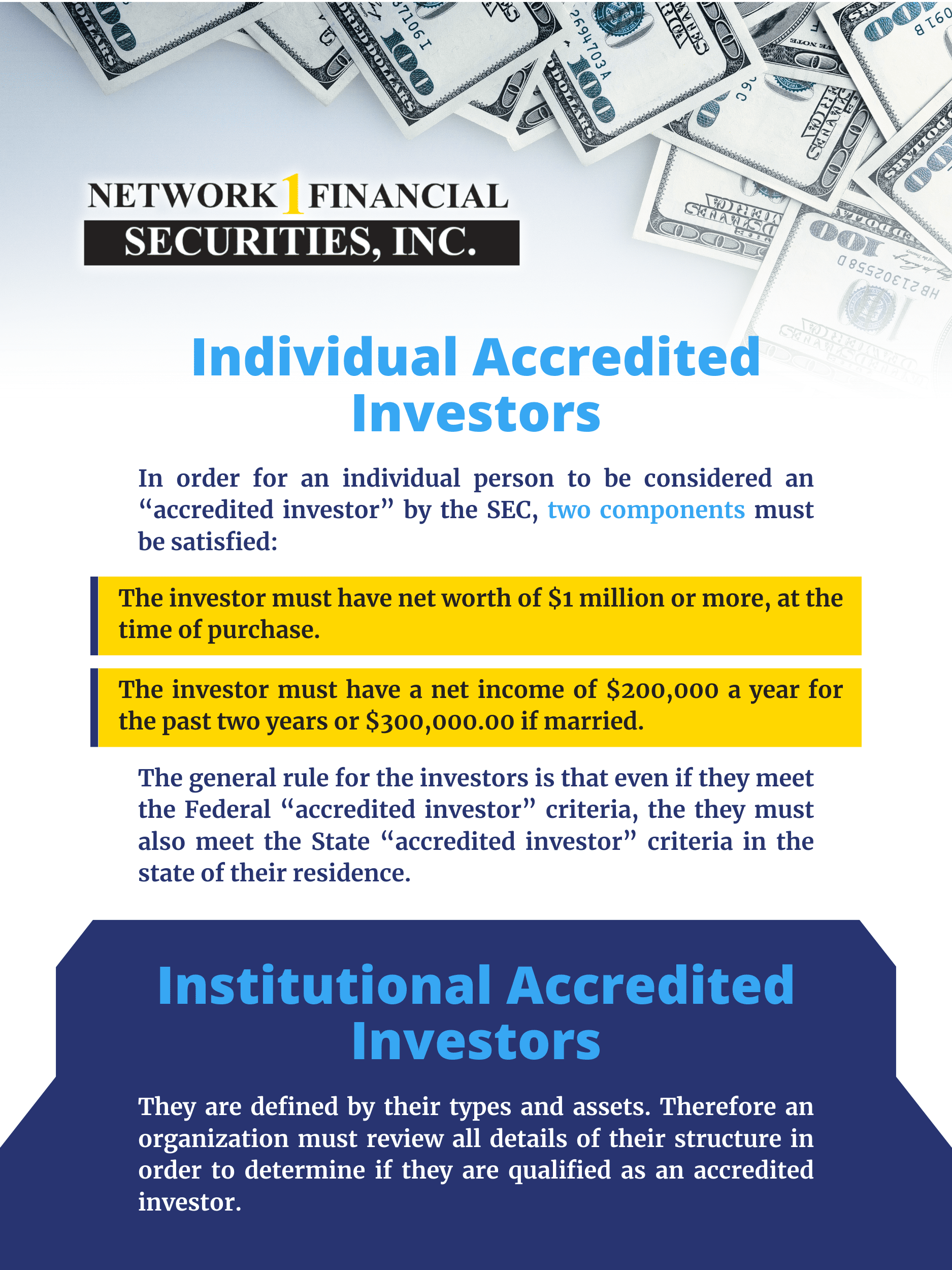

Have a net well worth going beyond $1 million - omitting one's main house. Be a general companion, executive police officer, supervisor or a related combination thereof for the provider of a safety being provided. The SEC considers these recognized investors to have a sufficient amount of riches as not to require the defense of federal and state safeties regulations to the very same degree that non-accredited investors do.

Verify Series 7 License

The question of exactly how the SEC can both secure private capitalists while still permitting growth of startups and other young firms will certainly proceed to be a warm topic in the coming years. As the SEC proved when they removed the value of primary residency in the assessment of accredited investors, they are paying attention.

The SEC regulates the guidelines for getting and marketing safety and securities consisting of when and just how securities or offerings need to be signed up with the SEC and what kinds of capitalists can participate in a particular offering. accredited investor vs qualified purchaser. As an on-line industrial property investing industry, all of our financial investment possibilities are readily available just to approved capitalists

Simply put, you're a certified capitalist if: OR ORYou are a holder in excellent standing of the Collection 7, Collection 65, or Series 82 licenses An accredited financier does not have to be an individual person; counts on, particular retirement accounts, and LLCs might also receive certified capitalist condition. Each spending capability may have a little various standards to be considered recognized, and this flowchart lays out the certification criteria for all entity kinds.

Within the 'accreditation verification' tab of your, you will be supplied the following options. Upload financials and documentation to show evidence of your accredited status based on the demands summed up above., certificate #"); AND clearly state that the investor/entity is a recognized capitalist (as specified by Rule 501a).

Please note that third-party letters are just legitimate for 90 days from day of issuance. Per SEC Rule 230 (real estate investing non accredited).506(c)( 2 )(C), prior to approving a capitalist right into an offering, sponsors need to get written proof of a financier's certification status from a certified third-party. If a third-party letter is offered, this will certainly be passed to the sponsor directly and should be dated within the previous 90 days

Rule 501 Regulation D Accredited Investor

After a year, we will need upgraded monetary papers for evaluation. For more details on accredited investing, see our Accreditation Introduction posts in our Assistance Center.

I highly suggest their solution for anyone that needs it in the crypto area. Easy to make use of. Scott WhiteCOO of MainstreetThe best component of raising capital for our new brewery, besides being successful, was the incredible level of professionalism and trust and client solution VerifyInvestor.com showed in every instance to our possible investors and to us.

The VerifyInvestor.com team is a pleasure; they made it simple for us to concentrate on the remainder of the resources raise which is specifically what is required. Dan JustesenPresident of Utepils Brewing CoI made use of VerifyInvestor.com for my crowdfunding campaign on Crowdfunder.com. The interface is very great, wonderful layout, and extremely easy to use.

Letter Of Accreditation Investor

I purchased the verification late in the day after 5pm, the investor underwent the procedure that same night without any questions or problems, and by the next morning, we had actually obtained a lawyer's letter confirming the confirmation. Joseph MorinCo-Founder/CEO of Social RewardsI had a phenomenal experience with VerifyInvestor.com. Great system.

Kate KalmykovShareholder of Greenberg TraurigVerifyInvestor.com is easy to utilize and, much more significantly, their team is easy to interact with - accredited investor disclaimer. We were shocked that they responded to our concerns and issues in such a brief time, and they managed our problems in an extremely responsible means. Stella Z.Foreign InvestorVerifyInvestor went beyond all my expectations

Michele P.InvestorI want to let you understand that I believe you have a terrific solution. I look onward to proceeding to utilize the verification solution. I am receiving wonderful comments from our capitalists, specifically concerning your support team.

Requirements To Become An Accredited Investor

You have actually made my difficult task so a lot less complicated! Linda Leiser. Investor Relations of Allante Quality LLCI needed some assistance going through my confirmation, and on a Sunday night, a principal of VerifyInvestor.com jumped on the phone and strolled me via the process to make sure that I might go on my holiday the following day without stressing.

I'm impressed that a principal of the firm would go to such great lengths to ensure that one client was satisfied. Brian L.InvestorWe use VerifyInvestor.com to verify financiers for our personal equity property funds. We have actually had a wonderful experienceprompt, considerate customer care, and they make it easy for our customers to publish their details to comply with the brand-new confirmation requirements.

I first confirmed myself and I discovered the website extremely simple to utilize. The worth for the degree of solution and the affordable are the reasons that I would enthusiastically suggest this solution to anybody needing to certify capitalists. Gary WishnatzkiCEO of Wish Farms and Supervisor of Harvest CROO Robotics.

Institutional Accredited Investor Rule 501

Over the previous numerous years, the recognized financier interpretation has been criticized on the basis that its sole emphasis on an asset/income test has actually unfairly excluded almost the most affluent individuals from financially rewarding investment possibilities - sophisticated investor status. In feedback, the SEC started thinking about ways to increase this meaning. After a substantial comment period, the SEC embraced these modifications as a method both to record people that have dependable, different indications of monetary sophistication and to update specific obsolete portions of the interpretation

The SEC's key issue in its regulation of non listed protections offerings is the protection of those financiers that do not have an adequate level of monetary class. This worry does not put on well-informed workers since, by the nature of their setting, they have enough experience and accessibility to financial details to make enlightened financial investment decisions.

The identifying factor is whether a non-executive staff member actually takes part in the exclusive investment firm's investments, which need to be identified on a case-by-case basis (non accredited investor opportunities). The enhancement of educated staff members to the recognized financier interpretation will likewise allow more staff members to purchase their company without the exclusive investment company risking its own status as an accredited financier

Passive Income For Non Accredited Investors

Before the amendments, some exclusive financial investment firms risked losing their recognized investor condition if they permitted their workers to invest in the business's offerings. Under the amended meaning, a greater number of exclusive investment firm staff members will now be eligible to invest (us accredited investor certificate). This not just creates an extra resource of resources for the private financial investment firm, however additionally further aligns the interests of the staff member with their company

Presently, just people holding certain broker or economic advisor licenses ("Collection 7, Series 65, and Series 82") qualify under the meaning, however the changes grant the SEC the capability to include additional certifications, designations, or credentials in the future. Particular types of entities have actually also been included to the interpretation.

The enhancement of LLCs is most likely one of the most notable enhancement. When the interpretation was last upgraded in 1989, LLCs were relatively rare and were not included as a qualified entity. Since that time, LLCs have actually ended up being exceptionally prevalent, and the interpretation has been modernized to reflect this. Under the changes, an LLC is considered a recognized financier when (i) it has at the very least $5,000,000 in possessions and (ii) it has actually not been formed only for the specific objective of acquiring the protections offered.

Latest Posts

Tax Repossessed Property

Property Tax Foreclosures

Properties With Tax Liens Near Me